Did You Get a Letter From Your Lender Saying You’re Behind on Your Payments?

Are you wondering what the Louisiana foreclosure process is like? I was too, so I went out to the Louisiana State Legislature website and read through a bit of the Louisiana Code of Civil Procedure. Then, I decided to make a quick four and a half minute video to summarize it, so you wouldn’t have to. I recommend just watching the video, or you can also click The Step By Step Foreclosure Process in Louisiana link for a brief PDF that I made.

However, if you do like reading legal codes, you can find it by clicking the following link https://www.legis.la.gov/legis/Laws_Toc.aspx?folder=68&level=Parent and reading CCP 2293, CCP 2331, CCP 2634, CCP 2638, CCP 2721, 2722, 2723, and 2724. It is not the most exciting subject, but knowing how much time you have to do something about it is very important, especially if you want to protect your credit score and your house!

As always, feel free to give us a call at 225-217-1778 or go to contact BuyHousesBR and fill out the form.

Video Transcription

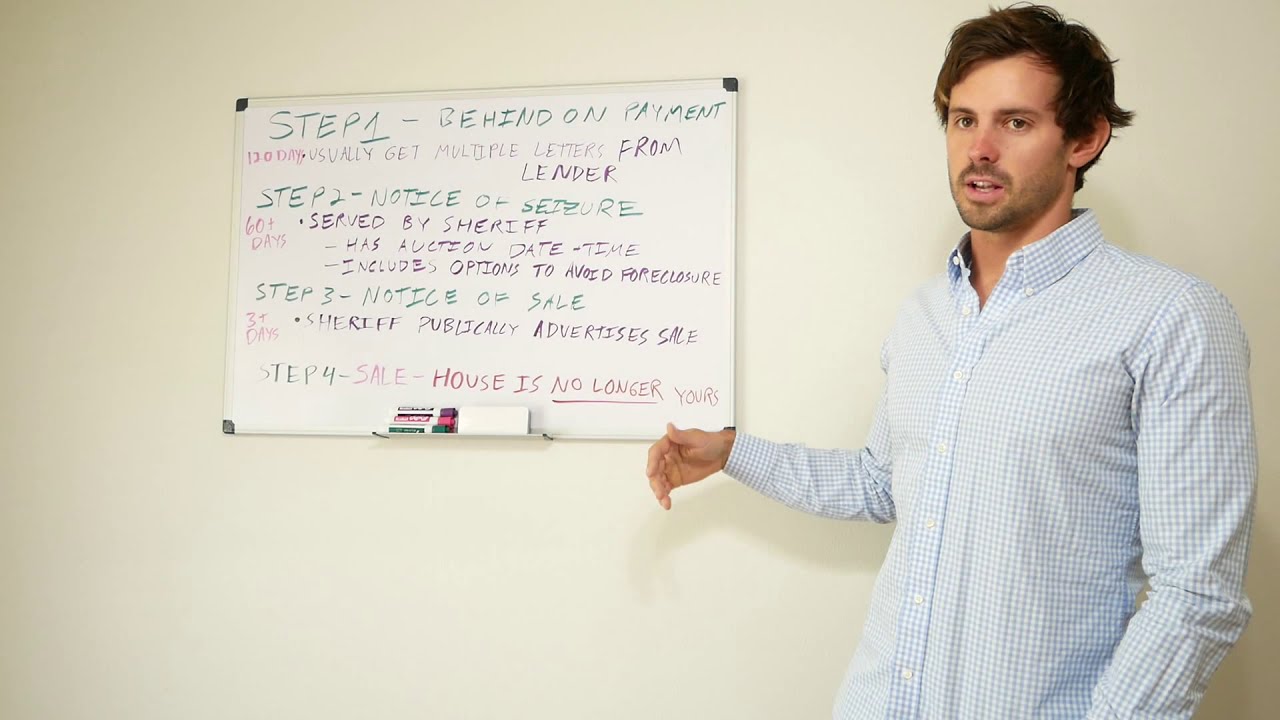

Today I’m going to go through the four main steps in the foreclosure process in Louisiana. I’m currently in Baton Rouge and I was just looking around online, trying to understand the process better. I noticed that there’s a lot of confusing information that doesn’t match other websites. So I went straight to the Code of Civil Procedure for Louisiana, which is where the laws basically are. I got the information straight from the source and summarized it in a fairly easy to understand simple four step process. Step one, you miss a payment. So at this point you’ll probably start getting letters from your lender or your bank and they’re going to be saying, “Hey, we want our money. So please send it in and catch up and get current.” So that process can go on for quite a while before anything can actually happen.

The federal law requires 120 days or more for you to solve your problem because they don’t want a bunch of foreclosures flooding the market either. So you should get a lot of letters in that time frame. But you won’t necessarily, if the bank’s not paying attention, then you might get nothing. They’re not required to send you anything.

Step two is the notice of seizure. So after that 120 days, your lender will file with the court and the court will say, “Okay, sheriff, go seize their property.” So you’ll get a notice of seizure from the sheriff. And on that notice you will have the auction date and time and you’ll have a few options to avoid the foreclosure. And these options are not very specific. It’s not like, do these steps and you’ll be fine. It’s more broad things, counseling, you can talk to this person and I have a picture of a notice of seizures. So I will blank out the addresses and everything, all the personal information and you guys can see what that looks like. Sheriff’s Notice of Seizure Example

Step three is the notice of sale. One thing I forgot to mention is between when the court files and the actual auction date, it has to be 60 or more days. So between when you get the notice of seizure and when the auction is, that’ll be a little less than 60 days usually, but close. Ok, so the notice of sale is next and that’s when the sheriff goes and advertises the sale. So, he’ll put it in the newspaper, he could put it on… in East Baton Rouge specifically, we have a website that has a listing and the dates of all the sales. So you can just pick a day and see everything that’s going to come up for auction that day. And that has to be three or more days from when he served you the notice of seizure.

Step four is the sale. So you don’t want to get to step four. Once you get to step four there’s absolutely nothing you can do. And one thing I forgot to mention at the beginning is as you go through these steps, you get fewer and fewer options. So here you have a ton of options, here you have a couple and once you get down here and here it’s really tough to get out of your situation. So the key here is to get started early and as soon as you start getting those letters from your lender, you need to start thinking about, “Hey, what can I do to get out of this situation,” and we can help with that as well. So you just give us a call and we’ll chat and walk you through a little bit. But yeah, I’ll cover each of these steps more in depth in the later videos. I just wanted to give everyone a broad overview in something that was hopefully pretty useful.

All right. Thanks a lot.