If you are wondering, “How do I save my credit in foreclosure“, there are a several options. In this short video, I will cover a few of them, plus, I will talk about what a credit score is and why they are important, as well as how certain things (missed payments, foreclosure, bankruptcy) impact your credit score.

Transcript: Hey Y’all, Travis Steinemann here with BuyHousesBR. Today I’m going to talk about credit scores, what they’re good for, and a couple of things that can happen to you that will decrease them. And if we have time at the end I’ll touch on a couple things that you can do to avoid those situations.

So, starting out, your credit score is basically your history of getting loans and paying them back. Any car loans, credit cards, mortgages, personal loans, anything like that, even cell phone bills can be included on your credit report. Anytime you miss a payment on that, it will go down, and when you consistently make payments, it will go up. These are good because whenever you need to get a loan, this is what they base your approval on. If you have good history, they will say ok, great, this person is safe to lend to, I will get my money back. So, they will be more likely to give you a good interest rate and give you the loan. If you have a bad credit score, they think, “oh this guy is really risky, I don’t know if I will get my money back, he might just default on me and go bankrupt” so they will be a lot less likely to give you a loan.

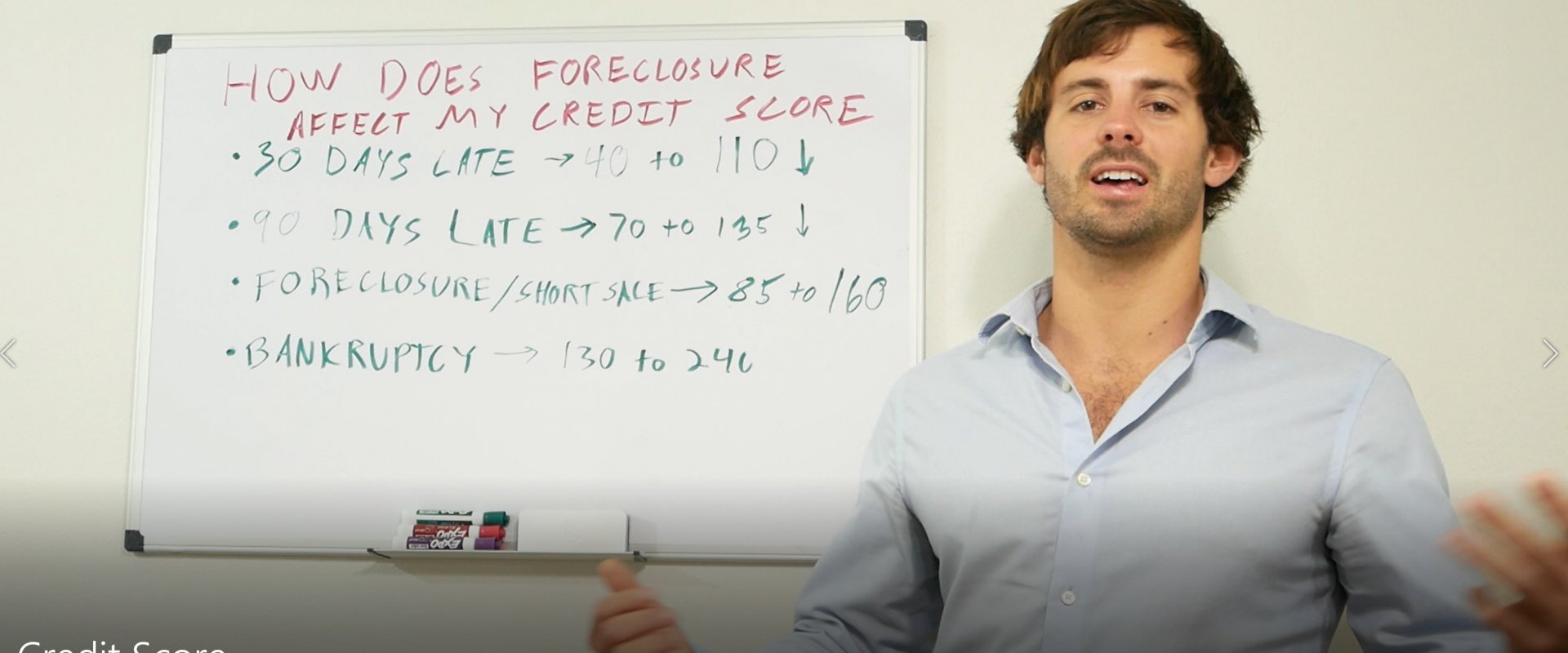

Going forward from there, there are a couple things that can negatively impact your credit score like being late… not making payments on time, not making payments at all, all of those things are really bad. Starting out, 30 days late you’re going to see a drop between 40 to 110 points. That’s a pretty big range. That 40 point range is if you already have a low score, and that 110 point is if you have a high score. High scores are in the 700s and 800s, low scores are 500 and 600, 650 is about that line where people like to lend above.

If you’re 90 days late you will see a 70 to 135 point drop. And these are significant numbers here. You’re going to see big differences in the interest rates and the approval odds.

A foreclosure and a short sale will impact you 85 to 160 points. And a short sale will have a little less impact than a foreclosure, but both of them are very, very damaging and they will stay on your credit report for 7 years. It doesn’t matter if you’ve made every payment since then, if you got foreclosed upon once, that is going to be on your report for seven years since the first missed payment. That’s a long time.

Bankruptcy is the final thing you can do to really damage your credit and you will see a drop between 130 to 240 points if you go bankrupt. That stays on for about 10 years so that is incredibly damaging. It can stop the foreclosure process momentarily, but in most cases, you still will lose your house and you still will have that massive hit so it’s not usually worth it. You might be thinking, “I missed a payment, what are my options?” “How do I avoid all of this from happening because that sounds terrible, I want to get a car in the future at some point!”.

This is the important part. The first thing you need to do is budget. You need to track all your expenses, all your income. Subtract out the groceries, gas bill, mortgage, car payment, (and all other expenses) from what you make. Hopefully there is money left over, and if there isn’t, you will have to cut your expenses and prioritize paying your mortgage, because that is the most important thing you have in your life right now.

The second thing you can do is renegotiate, and the budget from step one is very helpful in this because you can show the bank “Ok, I’m like $50 a month short, so I’m really close. If we can change the payment structure, if we can extend the loan longer so I have a little less to pay every month, I’ll have no problem.” The bank doesn’t want to take your house. They’re banks, they lend money, they don’t buy and sell houses. They will work with you in most cases and make it so you can make those payments, so you can keep your house, they can keep getting paid every month, and everyone is happy.

The third thing you can do is you can sell to us. If the bank won’t negotiate with you, if you look at your budget and say, ”Man, I am so far negative there is no way I can make this work”, we can step in. We will buy your house with cash, it will be fast, so we can do it early in the process, and you walk away with some cash so you can move into another house with slightly lower payments that you can afford, and we will take over the house and either rent it out or flip it.

If that sounds interesting to you – if you want to talk about any of those options, how to budget, how to renegotiate your loan, or if you are interested in selling, you can go to our website www.buyhousesbr.com or give us a call (225-2267-7488) the phone number is on the website as well.

Alright, thanks for watching this and I hope it was helpful.